Tax Progressivity and Income Inequality

579 kr

579 kr

On., 16 juli - ti., 22 juli

Sikker betaling

14 dagers åpent kjøp

Selges og leveres av

AdlibrisProduktbeskrivelse

Artikkel nr.

8cfdfcb3-e30e-5397-817a-77bff29c1956

Tax Progressivity and Income Inequality

579 kr

579 kr

On., 16 juli - ti., 22 juli

Sikker betaling

14 dagers åpent kjøp

Selges og leveres av

AdlibrisLignende toppselgere

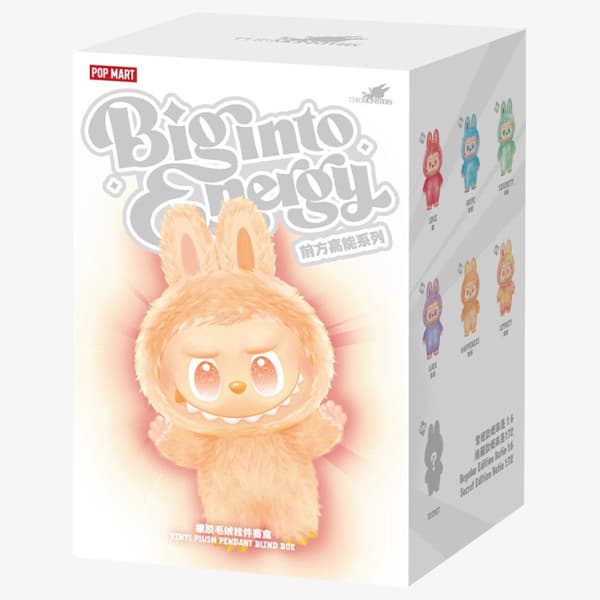

POP MART Labubu The Monsters Big Into Energy Series Figures Vinyl Plush Pendant Blind Box

699 kr

Øreputer for Bose QuietComfort - QC35/QC25/QC15/AE2 Hodetelefoner Svart

99 kr

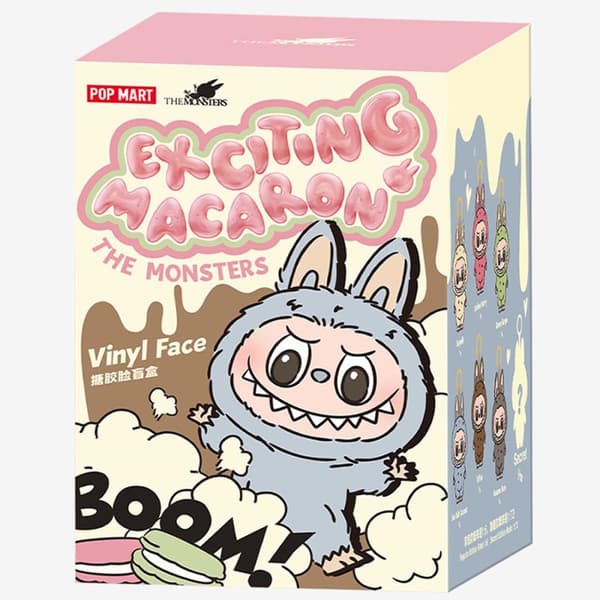

POP MART Labubu The Monsters Exciting Macaron Vinyl Face Blind Box

699 kr

INF TYPE-C Dual SD/TF-kortleser for rask dataoverføring 0

89 kr

Tidligere laveste pris:

99 kr

Hundetrimmer / Potetrimmer - Trimmer for Poter

199 kr

Max Smekker

99 kr

Tidligere laveste pris:

164 kr

NÖRDIC Lightning Kortläsare SD UHS-I

240 kr

Luftrenseenhet - Renser / Saniterer luften - 20,000 mg/h

699 kr

Filter for MSPA oppblåsbare bassenger FD2089 4-pakning

289 kr

Malibu Fast Tanning Bronzing Butter with Beta Carotene 300ml

179 kr

Anbefalinger til dig

INF Etterfilter til Dyson V11 / V15 akselstøvsuger 3-pakning

229 kr

Afnan Supremacy Collector's Edition Eau De Parfum 100 ml (man)

781 kr

INF Støydempende og lydisolerende ørepropper med krok

114 kr

Tidligere laveste pris:

143 kr

Batteri Varta Longlife Power LR03/AAA 18 pk

89 kr

INF Øreputer for Bose QC35 I/II, QC25, QC15, QC 2 AE 2, AE 2i, AE 2w, SoundTrue, SoundLink

99 kr

Tidligere laveste pris:

132 kr

INF Løkke for 22 mm klokkerem i 10-pakning Sort

69 kr

Tidligere laveste pris:

78 kr

3-Pak - Fidget Spinners med Sugekopp for Barn

179 kr

Sirkulasjonstrimmer-121-CT

1 295 kr

INF Spiralreflekterende fugleskremsel 10-pakning Sølv 30 cm

119 kr

Tidligere laveste pris:

143 kr

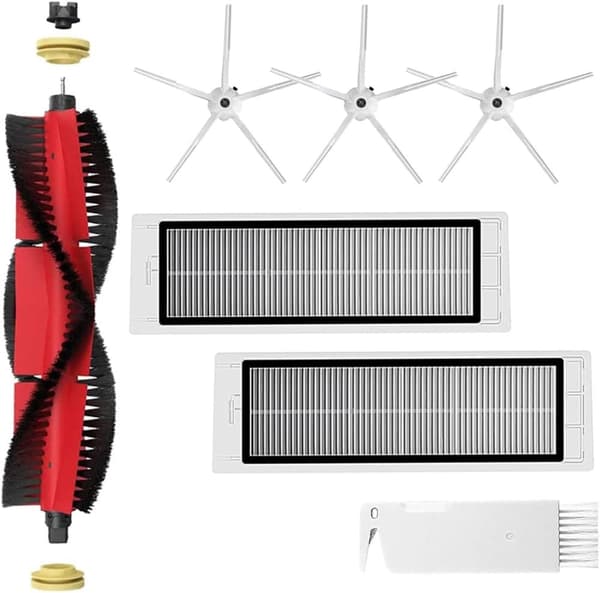

INF Tilbehør til Roborock S5/S6 modeller 7 deler

149 kr

Tidligere laveste pris:

228 kr